The Bank of Montreal

The Bank of Montreal

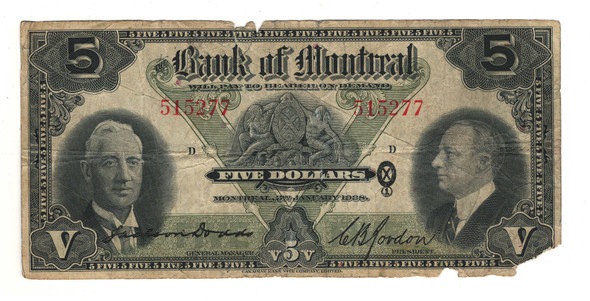

In 1817 the Bank of Montreal became the first institution to receive a Royal Charter to enter into operation in the Province of Canada. Its founding members, seven Montreal merchants, also received a Monopoly (soon to be disallowed) over the printing of banknotes, which were becoming more currently accepted in trade since their use by the British military in financing the War of 1812. Within a short amount of time, numerous branches quickly opened across Upper and Lower Canada, at York, Kingston and Quebec. With its first major acquisition in 1840 of the rival Toronto-based Bank of the People, and the rapid adoption of new technologies such as the Telegraph, the Bank found itself in a privileged position from which it acquired after 1867 the position of sole depository of the Government of Canada and (temporarily) that of sole issuer of “provincial bank notes”. Unfortunately, it also lost the right to the issuance of banknotes of face value under four dollars. Meanwhile, the Bank of Montreal was growing rapidly. In 1859, it opened its first office in New York, and in 1870, its first office in London, England. By the 1880’s the bank was in a position to place its financial support behind the construction of the trans-Canadian railway, the construction of which was a sine-qua-non for British Columbia’s entry into confederation. As construction moved westward and villages sprouted up around the tracks, so did new branches, such that the company’s business boomed. The 20th century brought with it a whirlwind of acquisitions, first in eastern Canada with such institutions as the Bank of Halifax, The Bank of Yarmouth, and the People’s Bank of New Brunswick. Later, in western Canada where the buyouts of the Bank of British North America, the Merchants’ bank of Canada and the Molson’s Bank opened headway into Ontario and the Prairies. The great boom ended with the depression, which the bank of Montreal survived, but not without the cost of the loss of its monopoly over government accounts following the creation of the Bank of Canada in 1935. It has since continued to grow, and the Bank of Montreal is today Canada’s fourth largest bank, with activities across over 900 branches and seven million clients. Since the first issue in 1823, bills were printed with denominations in both pounds and dollars until the advent of the Canadian dollar in the 1850’s. Bills valued solely in Canadian currency were issued throughout the 1900’s with the final five-dollar notes dating to 1942.

- Product

- Qty in Cart

- Quantity

- Price

- Subtotal

-

Canada: 1923 $5 Bank of Montreal Banknote

US $110.48Canada: 1923 $5 Bank of Montreal Banknote Reference: 505-56-02US $110.48 -

Canada: 1923 $5 Banknote - Bank of Montreal 2251767

US $139.94Canada: 1923 $5 Banknote - Bank of Montreal 2251767 Catalogue: 56-2US $139.94 -

Out of stock

Canada: 1935 $10 Banknote - Bank of Montreal 997611

US $117.84Canada: 1935 $10 Banknote - Bank of Montreal 997611 Catalogue: 505-60-04US $117.84 -

Canada: 1935 $5 Banknote - Bank of Montreal 760836

US $117.84Canada: 1935 $5 Banknote - Bank of Montreal 760836 Catalogue: 505-60-02US $117.84 -

Out of stock

Canada: 1935 $5 Banknote - Bank of Montreal VF20

US $117.84Canada: 1935 $5 Banknote - Bank of Montreal Catalogue: 505-60-02 Grade: VF20US $117.84 -

Canada: 1935 $5 Banknote - Bank of Montreal VF20 #2

US $117.84Canada: 1935 $5 Banknote - Bank of Montreal Catalogue: 505-60-02 Grade: VF20US $117.84 -

Out of stockOn Sale

Canada: 1938 $5 Bank of Montreal Banknote

Now: US $47.87Was: US $73.65Canada: 1938 $5 Bank of Montreal Banknote. Tears. Reference: 505-62-02Now: US $47.87Was: US $73.65